Text Markus Huneke ––– Photography

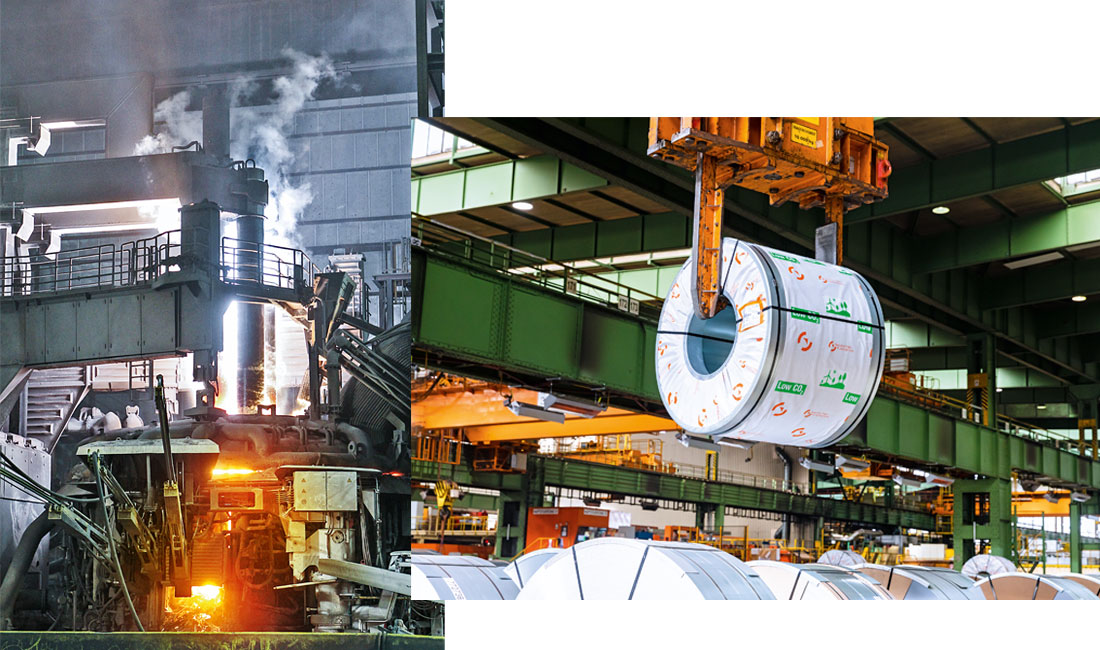

The heavy-duty crane slowly approaches and places the giant steel coil into the prepared storage space with pinpoint precision – 30 metric tons of high techsteel, one coil next to the other. The shimmer of the coils is still visible through the protective packaging – and with the matt sheen and clean edges, there’s no mistaking that this is a genuine precision product. Steel coils of this kind are generally destined for use in the automotive industry or other sectors such as the household appliance industry, which also rely on the high-quality flat steel produced by Salzgitter Group company Salzgitter Flachstahl GmbH.

What’s not obvious from looking at the coil, however, is all that’s gone on in the background before it was picked up by the crane – the technical production revolution that is shaking up the industry, complete with repercussions for the entire downstream processing chain.

FIRST DIRECT REDUCTION IN FOUR YEARS

When presenting the new “Salzgitter AG 2030” corporate strategy at the start of the year, Gunnar Groebler, CEO of Salzgitter AG, again made no bones about the fact that the timetable is an ambitious one. Instead of aiming to switch completely to the hydrogen- based production of high-quality steel by 2045, the steel production company, based in Lower Saxony, now wants to achieve this target a full twelve years earlier. The company is aiming to be the first steel producer to make the switch, replacing all three of the Group’s blast furnaces with direct reduction plants – which run on natural gas and hydrogen instead of coal – by 2033. The first direct reduction plant is to start operations in 2026.

A GRADUAL TRANSFORMATION

This is no trivial matter. Switching over production – that has already been taken to the very limits of technical process development – to the new technology is a major challenge, even for one of Germany’s biggest steel producers with an annual output of some six million metric tons. “Using the direct reduction process to produce pig iron from iron ore is completely different to the blast furnace method,” explains Phillip Meiser, Sales Director at Salzgitter Flachstahl GmbH.

“That’s why the transformation will run in stages up to 2033. This way, we can maintain continuous operations and avoid any supply issues for our customers.”

Even though the Salzgitter Group is one of the most efficient steel manufacturers in the world, its processes still produce around eight million metric tons of CO2 each year. As Groebler was keen to point out, Salzgitter AG has decided to strike out in a new direction and shake up its production to meet both its social and environmental responsibilities.

In the future, instead of using coking coal and a blast furnace to turn iron ore into pig iron, it will use hydrogen. This new process takes place in direct reduction plants, which emit water instead of CO2. Thanks to this process, steel production can genuinely become green.

GREEN HYDROGEN NEEDS GREEN ELECTRICITY

A key requirement is hydrogen that is sufficiently green – in other words, produced without carbon emissions. In turn, green hydrogen needs green electricity – power generated using renewable energy sources. One of the approaches taken by Salzgitter AG has seen the company recently entering into a strategic partnership with the Danish power company Ørsted, a green market leader in the planning, construction and operation of offshore wind farms. “If we’re going to use hydrogen to produce steel, we need enough energy. Offshore wind farms can produce and supply us with all the green energy we need,” Meiser explains. “However, that’s going to call for a whole new infrastructure, too.”

Infrastructure expansion is a critical aspect that could have a major impact on the speed of the transformation. Just like the entire industry, which is undergoing the same transformation process, Salzgitter AG needs support – not only for setting up a new infrastructure, but in terms of the necessary investment, too. “Switching to carbon-neutral production will cost around three to four billion euros in total. Salzgitter AG cannot cover these costs on its own. We need public funding for this project, too,” comments Meiser.

INDUSTRIAL USE – A MAJOR CHALLENGE

For some time now, the company has been actively paving the way for low-emission production through its SALCOS (Salzgitter Low CO2 Steelmaking) project. “We’re going to be able to cut our emissions by more than 95% compared to today’s figures – and will therefore come close to emission-free production,” emphasises Maik Lintl, Sales Director at Salzgitter Flachstahl GmbH. Despite all the innovations and the necessary technologies already being available, these are still separate elements. The main challenge is therefore to combine these and scale them up to a production volume which has never been seen before.

In technical terms, the prospects for success are looking good. However, the technical elements are just one side of the coin – the markets are the other. Will they buy steel that has been produced using the direct reduction method with almost no carbon emissions? “We are seeing a high demand for green steel. However, there’s no doubt that steel produced through direct reduction will be more expensive to begin with,” Lintl explains.

INITIAL SIGNS OF A SWITCH ON THE MARKET

If the transformation is to succeed, it’s not just the technical production processes that need to change – the markets have to change, too. The initial signs of this are already emerging. For instance, Mercedes- Benz AG and Volkswagen AG have recently placed orders with Salzgitter Flachstahl GmbH for green steel, as has household appliance manufacturer Miele. However, the steel is not yet being produced in direct reduction plants, but instead in an electric furnace at the company’s site in Peine. This furnace uses electrical power to melt scrap steel down into crude steel, which can then be processed to make new products.

Another look at the Salzgitter Flachstahl GmbH coil storage facility reveals the challenges facing steel processing companies on the other side of the production chain. The green label on the carefully packaged coils identifies them as LOW CO2 products. If it weren’t for the plastic film, nobody would be able to tell the difference between “normal” and low‑CO2 steel. In other words, steel processing companies need to be able to rely on the information provided by manufacturers and suppliers about the steel product they have ordered. They then have the extra step of comparing this information across different manufacturers and suppliers.

HOW MUCH CO2 IS REALLY ASSOCIATED WITH DIFFERENT PRODUCTS?

While, for some manufacturers, such as Salzgitter AG (in the future), green steel will be the result of the genuine transformation of the entire steel production process, other companies will use certificates to offset emissions and others again will produce steel exclusively from scrap by means of an electric process. Each of these approaches is equally valid – there is more than one solution. However, the variety of approaches and concepts makes life difficult for steel processing companies. How much CO2 is really associated with different products?

In the future, steel processing companies will be looking for answers to this question. The Stahlo steel service centre, which is part of the Friedhelm Loh Group, can now supply an initial answer. Stahlo and Salzgitter Flachstahl – already partners of many years’ standing – are now collaborating strategically in relation to green steel, too. Stahlo was quick to recognise the strategic importance of the green transformation of steel production – and to start thinking in specific terms about what a rising demand for green steel would mean for both the market and its customers. “Stahlo is one of the key independent steel service centres in Germany and an important strategic partner for us – and that applies to green steel, too,” says Meiser.

NEW CO2 LABEL GIVES CUSTOMERS AN OVERVIEW

Stahlo is the first and only steel service centre to have developed a label for classifying steel products in terms of their associated CO2 emissions in a very straightforward way. Similarly to the well-known scheme used for household appliances, this system for steel also has seven categories – from A = best emissions class to G = worst emissions class. The different classes are colour-coded, so it’s easy to see at a glance where exactly the steel stands in terms of CO2.

“In introducing this label, we’re not trying to pre-empt any official classification system,” explains Oliver Sonst, CEO of Stahlo. “However, until such time as there is an official system of this kind, we want to make it easier for our customers to get to grips with the whole subject of green steel now.”

In addition to the system’s seven emissions classes, twelve visual icons provide information about how a particular steel has been made. A stylised leaf represents use of green electricity, for example, while a flash of lightning stands for an energy mix, and so on. The system therefore makes it easy for customers to understand the combination of raw materials and processes that have been used to produce the steel. The label, which the company produced itself, drawing on its wealth of experience and large network, is not intended to provide any form of legal certification – it is merely intended to give customers some quick guidance.

“Using just twelve elements, we are providing our customers with an overview that they could otherwise only get by studying the relevant documents in detail. This saves them a lot of time and effort,” Sonst explains. “At the moment, Stahlo is therefore one big step ahead of the market. What’s more, the response from our customers tells us we’ve struck a chord here – the feedback has been unbelievable,” emphasises the Managing Director of Stahlo.

Products with the Salzgitter AG C label – in other words, less than 500 kg of CO2 per metric ton of steel – are already available from Stahlo this year. It is expected that the Group’s A+ products will be available from 2026, once the first direct reduction plant has been started up successfully.